When we think of prediction markets — those real-money forums where people bet on future events— we like to imagine that they distill collective intelligence into accurate forecasts. But what happens when the logic underlying those forecasts breaks down? Dr. Christopher Fisher, a cognitive modeler with Parallax Advanced Research and the Ohio Aerospace Institute, and his research colleagues Dr. Kevin Schmidt and Dr. Taylor Curley, Research Scientist & Cognitive Modeler with the Air Force Research Laboratory, recently tackled that question in their award-winning paper “Unpacking the election: unpacking effects in electoral prediction markets.”

Their work, which won the International Conference on Cognitive Modeling (ICCM) People’s Choice Award for Best Conference Paper, peels back the layers of how we think about probabilities — and how the mind’s quirks can ripple through even the most sophisticated forecasting tools.

Prediction Markets, Unpacked

At their core, prediction markets function like stock markets for future events. Each share’s price reflects the crowd’s consensus on the probability of an outcome — whether a presidential candidate will win, whether the Fed will raise interest rates, or any other clearly defined event.

According to Fisher, “The quality of a prediction market can be evaluated in two basic ways: accuracy — how close the price is to the final outcome — and coherence, which checks if prices of logically related markets follow basic rules of probability.”

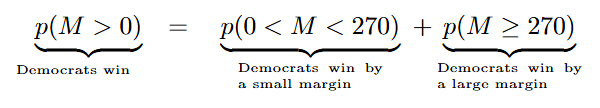

The team focused on a coherence metric called the additive rule. Imagine you divide a big event (like an election result) into sub-events (like winning by a small vs. large margin). In theory, the sum of the probabilities for the sub-events should equal the probability for the whole. But in practice, this neat logic often breaks down. That breakdown — known as an unpacking effect — hints that our minds don’t always follow classical probability.

Fisher and his colleagues found strong evidence of unpacking effects in the 2024 U.S. election markets.

“There were sustained periods of time where the additive rule didn’t hold,” he says. “It’s fascinating, because unpacking effects are common in individual judgments but much less reported in market behavior.”

To explain the disconnect, the team turned to quantum cognition — an alternative modeling framework inspired by quantum theory. In this view, the mind can treat certain ideas as incompatible, forcing us to evaluate them sequentially from different perspectives rather than all at once.

“The quantum model, which is sensitive to context and order, can predict unpacking effects,” Fisher explains.

By developing an agent-based model that combined quantum cognition with simulated trading behavior, the researchers could reproduce the same coherence breakdowns they observed in real markets.

Smarter Forecasting for National Security

For Fisher and his team, the work isn’t just academic.

“The ability to predict future geopolitical events is an important capability for the Department of Defense,” he says. “Prediction markets can aggregate insights from diverse experts — but if unpacking effects show up, that should make us skeptical of the forecasts.”

The research also has implications for detecting manipulation. If a bad actor tries to bias market prices, incoherence could be a red flag.

“Having multiple logically related prediction markets makes manipulation more costly and coherence metrics could help detect foul play,” Fisher adds.

A Window into Imperfect Rationality

So, what does this mean for anyone who follows prediction markets or bets on election outcomes?

Fisher’s takeaway is cautionary: “Markets aren’t perfect. Economic models assume people act rationally, but that’s not always the case. Prediction markets still have value, but understanding their cognitive limits is crucial.”

His suggestion for market platforms is simple but powerful: give traders tools to spot unpacking effects in real time. That transparency could help correct mispricing and make these markets more robust.

What’s Next to Unpack?

Looking ahead, Fisher says the next step is to test the quantum cognition model’s causal mechanisms with controlled experiments. If there’s one thing Fisher’s work makes clear, it’s that the mind’s subtle biases don’t disappear when people bet on future events. Sometimes, the path to better forecasts starts not with the numbers — but by unpacking how we think.

“We showed that the quantum cognition model can replicate the qualitative unpacking effects — but can we validate the ‘why’ behind it? That’s our next challenge.”

About Dr. Christopher Fisher:

Dr. Fisher is a cognitive modeler with Parallax Advanced Research and Ohio Aerospace Institute. His work uses mathematical and computational models of cognition to understand decision making, multitasking, and cognitive workload. He has contributed to cutting-edge projects comparing heuristic and quantum decision models and exploring how prediction markets can be manipulated — all while helping the Department of Defense and the broader research community better understand the human mind.

###

About Parallax Advanced Research & the Ohio Aerospace Institute

Parallax Advanced Research is a research institute that tackles global challenges through strategic partnerships with government, industry, and academia. It accelerates innovation, addresses critical global issues, and develops groundbreaking ideas with its partners. In 2023, Parallax and the Ohio Aerospace Institute, an aerospace research institute located in Cleveland, OH, formed a collaborative affiliation to drive innovation and technological advancements across Ohio and the nation. The Ohio Aerospace Institute plays a pivotal role in advancing aerospace through collaboration, education, and workforce development. More information can be found at parallaxresearch.org and oai.org.